In the fast-paced world of financial markets, where every tick and fluctuation can make or break fortunes, understanding the tools at your disposal is crucial. Among these tools, one stands out for its simplicity yet profound insight: the Japanese candlestick.

What are Japanese Candlesticks?

Japanese candlesticks are a form of technical analysis used in trading to visualize price movements over a certain period. Unlike traditional line charts, which show only the closing price, candlestick charts provide a more comprehensive view by depicting the opening, closing, high, and low prices for a given time frame.

Origins and Evolution of Japanese Candlesticks:

The origins of Japanese candlestick charting can be traced back to the 17th century, where it was used by rice traders in Japan to track market sentiment and price movements. Over time, this technique evolved and gained popularity among traders worldwide due to its effectiveness in predicting market trends.

Understanding Japanese Candlesticks Patterns:

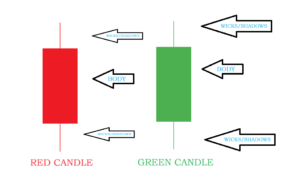

Candlestick charts consist of individual candlesticks, each representing a specific time frame, such as a day, week, or hour, depending on the trader’s preference. These candlesticks come in different shapes and colors, each carrying valuable information about the price action during that period.

The Anatomy of a Japanese Candlesticks:

- Body: The thick part of the candlestick represents the price range between the opening and closing prices. If the closing price is higher than the opening price, the body is typically filled or colored, indicating a bullish (positive) sentiment. Conversely, if the closing price is lower than the opening price, the body is usually hollow or a different color, signaling a bearish (negative) sentiment.

- Wicks/Shadows: The thin lines above and below the body, known as wicks or shadows, illustrate the high and low prices reached during the period. These wicks provide additional insights into price volatility and potential reversal points.

Interpreting Candlestick Patterns:

While individual candlesticks offer valuable information, traders often look for patterns formed by multiple candlesticks to make more informed decisions.

Some common japanese candlesticks patterns include:

- Doji: A candlestick with a small body, indicating that the opening and closing prices are virtually the same. It suggests indecision in the market and potential reversal.

- Hammer: A bullish reversal pattern that forms at the bottom of a downtrend. It has a small body with a long lower wick, resembling a hammer. It suggests a potential reversal to the upside.

- Hanging Man: A bearish reversal pattern that forms at the top of an uptrend. It has a small body with a long lower wick, resembling a hanging man. It indicates a potential reversal to the downside.

- Engulfing Patterns:

- Bullish Engulfing: A bullish reversal pattern that occurs when a large bullish candle fully engulfs the previous smaller bearish candle. It signals a shift from bearish sentiment to bullish sentiment.

- Bearish Engulfing: A bearish reversal pattern that occurs when a large bearish candle fully engulfs the previous smaller bullish candle. It signals a shift from bullish sentiment to bearish sentiment.

- Morning Star: A bullish reversal pattern that consists of three candles. It begins with a long bearish candle, followed by a small-bodied candle with a lower closing price, and finally a long bullish candle with a higher opening price that closes beyond the midpoint of the first candle.

- Evening Star: A bearish reversal pattern that is the opposite of the Morning Star. It consists of three candles, starting with a long bullish candle, followed by a small-bodied candle with a higher closing price, and finally a long bearish candle that closes beyond the midpoint of the first candle.

- Shooting Star: A bearish reversal pattern that forms at the top of an uptrend. It has a small body with a long upper wick, resembling a shooting star. It suggests a potential reversal to the downside.

- Inverted Hammer: Similar to the Shooting Star but occurs at the bottom of a downtrend. It has a small body with a long upper wick and signals a potential reversal to the upside.

- Dark Cloud Cover: A bearish reversal pattern that occurs when a bearish candlestick forms after a bullish candlestick, with the closing price of the bearish candlestick falling below the midpoint of the previous bullish candlestick.

- Piercing Pattern: A bullish reversal pattern that occurs when a bullish candlestick forms after a bearish candlestick, with the closing price of the bullish candlestick rising above the midpoint of the previous bearish candlestick.

Utilizing Japanese Candlesticks in Trading:

Japanese candlesticks can be a powerful tool for traders when used in conjunction with other technical indicators and analysis methods. By understanding the various patterns and their implications, traders can identify potential entry and exit points, manage risk more effectively, and improve overall trading performance.

However, it’s essential to remember that candlestick patterns are not foolproof indicators and should be used in combination with other forms of analysis and risk management strategies. Additionally, like any trading tool, they are subject to interpretation and occasional false signals, so it’s crucial to exercise caution and continually refine one’s skills.

In conclusion, Japanese candlesticks offer traders a unique and insightful way to analyze price movements and market sentiment. By mastering the art of candlestick charting and incorporating it into their trading strategy, traders can gain a competitive edge in the dynamic world of financial markets.

To open an account with Zerodha and receive 100% reimbursement of account opening charges from me, click here:

For any further queries regarding trading, investments, or other related matters, please feel free to contact us.