As February draws to a close, the world of finance is abuzz with the latest wave of initial public offerings (IPOs), marking an exciting culmination to the month. From tech startups disrupting industries to established companies venturing into new markets, each IPO represents a significant milestone in the journey of these firms towards greater visibility and access to capital. As investors eagerly await the debut of these new offerings, the landscape of opportunities and risks continues to evolve. In this blog post, we delve into the noteworthy IPOs that have emerged at the end of February, shedding light on the companies, their stories, and the implications for the broader market.

Let’s delve deeper into the dynamics driving these last-minute investment decisions and uncover the potential implications for the market landscape. As the month of February nears its end, investors are closely scrutinizing the final IPOs hitting the market, weighing factors such as company performance, market sentiment, and economic indicators. These decisions are not made lightly; they reflect the culmination of extensive research, analysis, and risk assessment. By examining the drivers behind these investment choices, we can gain valuable insights into current market trends and anticipate how they may shape the investment landscape moving forward.

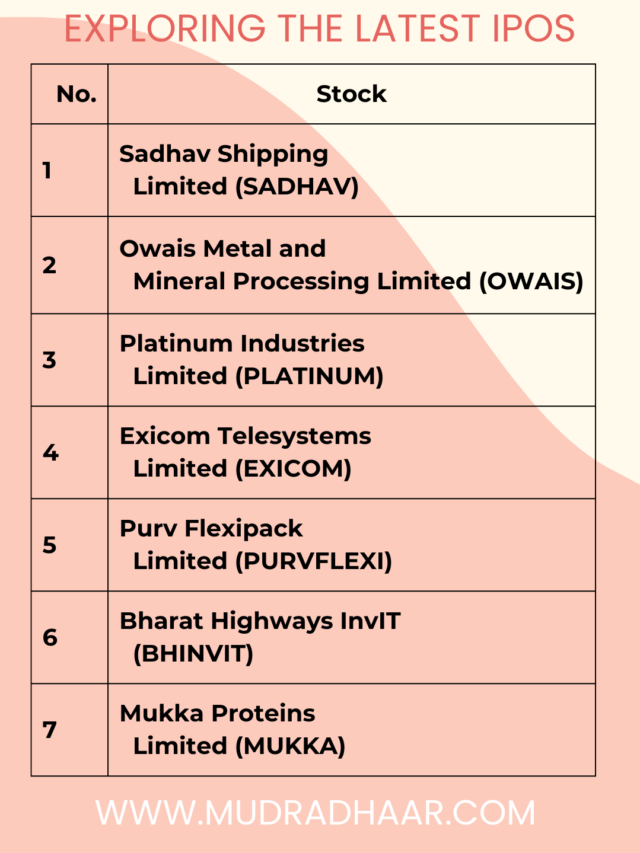

List of February Finale IPOs:

| Serial No. | Stock | IPO Start Date | IPO End Date | Listing Date | Min. Price | Max. Price | Min. Qty | Min. Value | Max.Vvalue |

| 1 | Sadhav Shipping Limited (SADHAV) | 23-Feb-24 | 27-Feb-24 | 01-Mar-24 | 94 | 95 | 1200 | 112800 | 114000 |

| 2 | Owais Metal and Mineral Processing Limited (OWAIS) | 26-Feb-24 | 28-Feb-24 | 04-Mar-24 | 83 | 87 | 1600 | 132800 | 139200 |

| 3 | Platinum Industries Limited (PLATINUM) | 27-Feb-24 | 29-Feb-24 | 05-Mar-24 | 160 | 171 | 87 | 13920 | 14877 |

| 4 | Exicom Telesystems Limited (EXICOM) | 27-Feb-24 | 29-Feb-24 | 05-Mar-24 | 135 | 142 | 100 | 13500 | 14200 |

| 5 | Purv Flexipack Limited (PURVFLEXI) | 27-Feb-24 | 29-Feb-24 | 05-Mar-24 | 70 | 71 | 1600 | 112000 | 113600 |

| 6 | Bharat Highways InvIT (BHINVIT) | 28-Feb-24 | 01-Mar-24 | 06-Mar-24 | 98 | 100 | 150 | 14700 | 15000 |

| 7 | Mukka Proteins Limited (MUKKA) | 29-Feb-24 | 04-Mar-24 | 07-Mar-24 | 26 | 28 | 535 | 13910 | 14980 |

In the next section, we’ll take a closer look at the backgrounds of the key players in this round of offerings, shedding light on what sets them apart in today’s competitive landscape. By delving into the histories of these companies, we aim to uncover the unique value propositions that have captured the attention of investors. Behind every IPO lies a unique narrative—whether it’s a tech startup disrupting an industry or a traditional company making its debut on the public market. By delving into the backgrounds of these companies, we unravel the intricate tapestry of their journeys, from inception to the present moment.

Let’s explore the profiles of the companies set to debut in the upcoming IPO wave, uncovering the narratives that fuel their journey towards the public market:

1. Sadhav Shipping Limited (SADHAV): Sadhav Shipping Limited is a prominent player in the maritime logistics industry, specializing in providing comprehensive shipping solutions globally. Sadhav Shipping has earned a reputation for reliability and efficiency in bulk cargo transportation, container shipping, and logistics services. With a modern fleet and a commitment to excellence, the company continues to expand its reach and serve a diverse clientele. Click here to read the red herring prospectus from SEBI website.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Sadhav Shipping Limited (SADHAV) | 10 | 10333818 | 4018800 | 14352618 | 96.44% |

2. Owais Metal and Mineral Processing Limited (OWAIS): Owais Metal and Mineral Processing Limited is a key player in the mining and processing sector, known for its expertise in extracting and processing various metals and minerals sustainably. Owais Metal and Mineral Processing adheres to stringent environmental standards while meeting the global demand for metals and minerals through responsible mining practices and innovative processing techniques.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Owais Metal and Mineral Processing Limited (OWAIS) | 10 | 13275198 | 4907200 | 18182398 | 100.00% |

3. Platinum Industries Limited (PLATINUM): Platinum Industries Limited stands out in the industrial sector as a leading manufacturer renowned for its commitment to quality and innovation. The company’s state-of-the-art manufacturing facilities produce a diverse range of high-quality industrial products, serving various industries. With a focus on customer satisfaction and technological advancement, Platinum Industries continues to set industry standards and expand its market presence. Click here to read the red herring prospectus from SEBI website.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Platinum Industries Limited (PLATINUM) | 10 | 41163648 | 13761225 | 54924873 | 94.74% |

4. Exicom Telesystems Limited (EXICOM): Exicom Telesystems Limited is a distinguished player in the telecommunications industry, offering cutting-edge solutions and services to meet the evolving needs of the sector. The company’s expertise lies in network infrastructure, broadband services, and mobile technology solutions. With a strong focus on innovation and customer-centricity, Exicom Telesystems remains at the forefront of technological advancements in the telecommunications domain. Click here to read the red herring prospectus from SEBI website.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Exicom Telesystems Limited (EXICOM) | 10 | 97655501 | 23169014 | 120824515 | 93.28% |

5. Purv Flexipack Limited (PURVFLEXI): Purv Flexipack Limited is a leading manufacturer of flexible packaging solutions, catering to diverse industries such as food and beverage, pharmaceuticals, and consumer goods. The company’s state-of-the-art manufacturing facilities produce a wide range of flexible packaging products tailored to meet the unique requirements of its clients. With a focus on sustainability and product innovation, Purv Flexipack continues to be a preferred packaging partner for businesses worldwide.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Purv Flexipack Limited (PURVFLEXI) | 10 | 15318950 | 5664000 | 20982950 | 92.17% |

6. Bharat Highways InvIT (BHINVIT): Bharat Highways InvIT is a prominent infrastructure investment trust focused on investing in road and highway projects across India. The trust provides investors with an opportunity to participate in India’s infrastructure growth story while generating stable returns through toll revenues and capital appreciation. With a portfolio of strategic road assets, Bharat Highways InvIT plays a crucial role in financing and developing critical infrastructure projects in the country. Click here to read the red herring prospectus from SEBI website.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Bharat Highways InvIT (BHINVIT) | 10 | – | – | 250000000 | – |

7. Mukka Proteins Limited (MUKKA): Mukka Proteins Limited is a leading player in the food and beverage industry, specializing in the production of high-quality protein products. The company’s commitment to quality, nutrition, and innovation has positioned it as a preferred choice among health-conscious consumers. With a diverse range of protein-rich products catering to various dietary needs, Mukka Proteins continues to promote health and wellness while maintaining environmental sustainability. Click here to read the red herring prospectus from SEBI website.

| Stock | Face Value Per Share | Pre Issue Shares | Fresh Issue Shares | Total Issues | Pre Issue Promoter Shareholding |

| Mukka Proteins Limited (MUKKA) | 1 | 220000000 | 80000000 | 300000000 | 100.00% |

These companies each bring distinctive strengths and visions to the forefront, laying the foundation for a thrilling IPO season ahead.

If you have applied for an IPO, you can check the status of your allotment by clicking here. Simply input your application number or PAN number to access the information. Please note that the link would be an actual hyperlink leading to the relevant website for checking IPO allotment status.

To open an account with Zerodha and receive 100% reimbursement of account opening charges from me, click here:

For any further queries regarding trading, investments, or other related matters, please feel free to contact us.